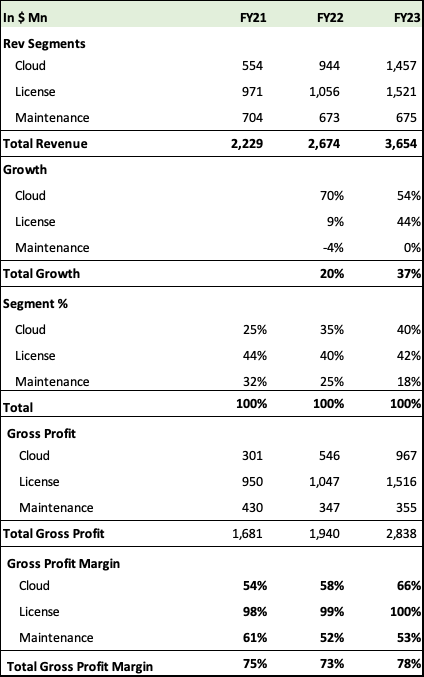

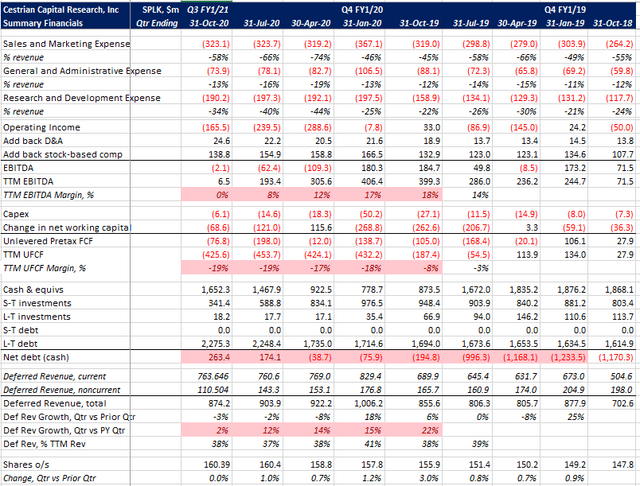

As we will explore in the next section, Splunk needs to invest in more capabilities to stay competitive. I also expect the utilization of equity to fuel acquisitions via share compensation to trigger EPS volatility. While liquidity (current ratio of 2.4x, cash of $2b) remains strong, I expect the huge debt on its balance sheet to drive risk premium given the suspension of its long-term cash flow target. I expect the growth initiatives to continue to drive margin volatility. To accelerate growth, Splunk has had to tap its balance sheet to achieve a blend of organic and acquisition-driven growth. The market has rewarded companies with lofty growth. In terms of capital management, the pursuit of growth continues to weigh heavily on Splunk's liquidity and cash position. The OpEx improvement was accretive to operating margin and EPS. OpEx management benefited from COVID-related savings. Regardless, GAAP gross margin ticked up sequentially to 76% last quarter. In recent quarters, gross margin has declined due to expenses incurred to scale the cloud business. The flexible pricing options should drive margins as customers grow the usage and consumption of cloud offerings. Source: Author (using data (GAAP) from Seeking Alpha) After all, playing with data, interrogating data, correlating data, that is where the value comes from. This enables our customers to send as much data as they want into Splunk Cloud and only pay for the workload or the resources that they need to actually use their data. This was highlighted during the last investor & analyst session:īecause of this, we delivered a new pricing model, workload-based pricing. On the sales front, Splunk has simplified the ease of consumption of its offerings via flexible pricing options. The recent acquisitions will boost Splunk's competitive positioning and growth as it accelerates the momentum of the cloud segment. It also validates Splunk's investments in observability. The performance of these observability players highlights the strong demand for DevOps solutions. GartnerĬloud observability players such as Datadog, Dynatrace, and Elastic have reported solid results in recent quarters. It also announced the acquisition of Flowmill for NPM (network performance monitoring).īy 2024, 50% of network operations teams will be required to rearchitect their network monitoring stack, due to the impact of hybrid networking, which will be a significant increase from 20% in 2019.

Both RUM and Synthetics help with front end monitoring (DEM). It has added observability capabilities such as RUM (real user monitoring) and Synthetics via the acquisition of Plumbr and Rigor. Splunk has significantly improved the capabilities of its offerings in recent quarters. This informs my neutral rating heading into CY'21. While Splunk's capabilities are strong, the growth factor is lacking.

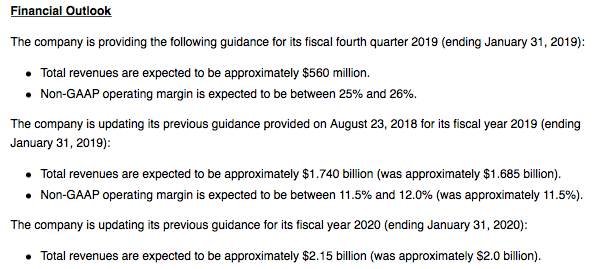

The market is looking for a best of breed platform with strong growth momentum. The guidance isn't encouraging given the strong results reported by cloud observability platforms such as Datadog ( DDOG), Dynatrace ( DT), and Elastic ( ESTC). Going forward, the forward guidance calls for flattish revenue growth in Q4'21. As a leading DevSecOps platform, the earnings miss calls out the impact of the turbulent macro environment on the sustainability of the strong earnings momentum in the cloud/SaaS space. While management reported impressive growth metrics to highlight the strength of Splunk's cloud offerings, the market barely budged. The result means the Street is now increasingly wary of Splunk's growth story.

#Splk seeking alpha license

The miss impacted both cloud and license revenue. Management attributed the miss to macro headwinds and sales execution issues. Revenue growth was negative, a big miss from the previous guidance. In Q3'21, Splunk reported topline results that underperformed management's prior guidance and the Street's expectations. Given that the market hasn't generously valued companies undergoing this shift and worsened by the recent earnings underperformance, the potential for multiple expansion remains slim in the short term. While it has solid capabilities that play into favorable tech trends, the growth story isn't resonating with investors due to the impact of the shift to cloud subscription on its topline results. Splunk ( NASDAQ: SPLK) is under intense pressure to deliver.

0 kommentar(er)

0 kommentar(er)